The Ig Nobel Prize-winning Italian researchers who demonstrated the benefits, for organizations, of promoting people at random have turned their analytical weapons on a new target. Their new study examines what happens over the long term if one randomly, rather than systematically, chooses stocks:

“Are random trading strategies more successful than technical ones?” A.E. Biondo, A. Pluchino, A. Rapisarda, D. Helbing, arXiv:1303.4351, March 18 2013. The authors explain:

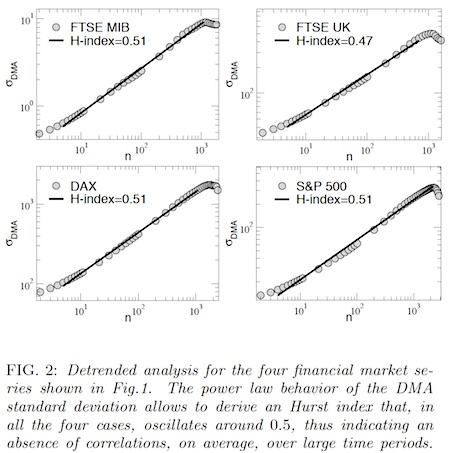

“we study the performance of some of the most used trading strategies in predicting the dynamics of financial markets for different international stock exchange indexes, with the goal of comparing them with the performance of a completely random strategy. In this respect, historical data for FTSE-UK, FTSE-MIB, DAX, and S&P500 indexes are taken into account for a period of about 15-20 years (since their creation until today)….

“Our main result, which is independent of the market considered, is that standard trading strategies and their algorithms, based on the past history of the time series, although have occasionally the chance to be successful inside small temporal windows, on a large temporal scale, perform on average not better than the purely random strategy, which, on the other hand, is also much less volatile. In this respect, for the individual trader, a purely random strategy represents a costless alternative to expensive professional financial consulting, being at the same time also much less risky, if compared to the other trading strategies.”

The study includes this chart:

HISTORY: The 2010 Ig Nobel Prize in management was awarded to Alessandro Pluchino, Andrea Rapisarda, and Cesare Garofalo of the University of Catania, Italy, for demonstrating mathematically that organizations would become more efficient if they promoted people at random. REFERENCE: “The Peter Principle Revisited: A Computational Study,” Alessandro Pluchino, Andrea Rapisarda, and Cesare Garofalo, Physica A, vol. 389, no. 3, February 2010, pp. 467-72.]